By: Bryan Davis

Click here to view or print the entire October report compliments of the ACRE Corporate Cabinet.

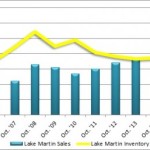

Sales: Lake Martin area* residential sales totaled 42 units in October, an increase in sales growth of 2.4 percent from the same period last year. This also establishes a new October peak after 41 units were sold a year ago. Year-to-date sales through October are up 28 percent above 2014. Two more resources to review: Quarterly Report and Annual Report

Forecast: October sales were 2.4 percent or one unit above our monthly forecast. Alabama Center for Real Estate’s (ACRE) year-to-date sales forecast through October projected 432 closed transactions while the actual sales were 525 units, a rise of 21.5 percent.

Supply: The Lake Martin area housing inventory in October was 448 units, a decrease of 14.8 percent from October 2014 and 38 percent below (this is good news) the October peak in 2008 (722 units). In addition, October inventory decreased by 6.5 percent from the prior month. This direction is right in line with historical data indicating that October inventory on average (2010-14) decreases from September by 3.3 percent. There were 10.7 months of housing supply in October (6.0+/- months considered equilibrium in October NSA), a favorable decrease of 16.9 percent from last October’s 12.8 months of supply.

Demand: Residential sales slipped 17.6 percent from the prior month. This direction is consistent with seasonal patterns and historical data indicating October sales on average (2010-14) decrease by 6.4 percent from September.

Pricing: The Lake Martin area median sales price in October was $306,150, an increase of 22.5 percent from October 2014 but a 7.2 percent decrease compared to the prior month. Historical data indicate that the October median sales price (2010-14) typically decreases 10.8 percent from September. Pricing can and will fluctuate from month to month due to changing composition of actual sales (lakefront vs. non-lakefront) and the sample size of data (closed transactions) being subject to seasonal buying patterns. A broader lens as to pricing trends is appropriate and we highly recommend contacting a local real estate professional for additional market pricing information.