By: Alabama Center for Real Estate

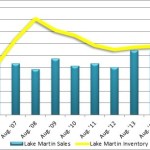

Sales: Lake Martin Area* residential sales totaled 61 units in August, an increase in sales growth of 13 percent from the same period last year. Year-to-date sales through August are up 36.7 percent above 2014.

Two more resources to review market: Quarterly Report and Annual Report

Forecast: August sales were 10 percent or six units above of our monthly forecast. ACRE’s year-to-date sales forecast through August projected 342 closed transactions while the actual sales were 432 units, a cumulative variance of 26.3 percent.

Supply: The Lake Martin Area housing inventory in August was 498 units, a decrease of 18.9 percent from August 2014 and 39.3 percent below(this is good news) the month of August peak in 2008 (820 units). In addition, August inventory decreased by 2.5 percent from the prior month. This direction is right in line with historical data indicating that August inventory on average (’10-’14) increases from the month of July by 2.5 percent. There were 8.2 months of housing supply in August (6.0+/- months considered equilibrium in August NSA), a favorable decrease of 28.2 percent from last August’s 11.4 months of supply.

Demand: Residential sales slipped 15.3 percent from the prior month. This direction contrasts with seasonal patterns and historical data indicating August sales on average (’10-’14) increase by 20.5 percent from the month of July.

Pricing: The Lake Martin Area median sales price in August was $290,000, a decrease of 17.6 percent from August 2014 but a 16 percent increase compared to the prior month. Historical data indicates that the August median sales price (’10-’14) typically decreases 19.4 percent from the month of July. Pricing can and will fluctuate from month-to-month due to changing composition of actual sales (lakefront vs non-lakefront) and the sample size of data (closed transactions) being subject to seasonal buying patterns. A broader lens as to pricing trends is appropriate and we highly recommend contacting a local real estate professional for additional market pricing information.

Industry Perspective: “Home sales have trended up and inventories are lean, supporting strong home price appreciation. That price growth, driven by laggard supply response, helps build equity for existing owners but is a headwind for first-time buyers,” said Doug Duncan, senior vice president and chief economist at Fannie Mae.”Given significant uncertainties from Greece and China, continued global monetary easing, and an expected slow pace of monetary tightening by the Fed, we anticipate mortgage rates to rise only gradually through next year, which should continue to help support mortgage demand.” For full report, go HERE.